The Corporate Sustainability Reporting Directive (CSRD) and the related European Sustainability Reporting Standards (ESRS) currently require all companies in the EU with more than 250 employees or meeting other financial criteria to publish a sustainability report. But what does that actually entail? How should such a report look? This article will answer that question, laying out the steps required to prepare your first sustainability report in alignment with the requirements of the ESRS.

Note of caution: the below description refers to the current ESRS standards published in 2023, however following the EU Omnibus proposal the requirements are expected to change. Nevertheless, it is expected that the core components of the process will remain the same.

This article was updated in May 2025.

This article was updated in May 2025.

In this article:

Non-financial reports, or sustainability reports, must share the same scope and time horizon as financial reports, in the case the company is already doing financial reporting. In addition, ESRS reports must also include information about the company’s impact, risks and opportunities relating to its full upstream and downstream value chain. Companies will have to define which parts of the value chain are in the scope of the report. Time horizons used in the report (short, medium and long-term) must also be defined.

A double materiality assessment (DMA) is the basis of every sustainability report—and ultimately sustainability strategy. It is the way that companies will find out which sustainability-related impacts, risks and opportunities (IROs) to prioritize for data collection and the development of policies, actions and targets. Double materiality has two parts, impact materiality and financial materiality.

Impact materiality

Impact materiality is about understanding the external impacts that your company and its value chain have on nature, society and other stakeholders—traditionally referred to as “externalities”. A key tool for identifying such impacts is stakeholder engagement, which is the act of engaging with impacted stakeholders or their representatives to understand how your company is affecting them. For environmental issues, numerous tools and assessment approaches exist—from carbon footprint calculations, to location-based analyses, to lifecycle assessments—to enable you to better understand your company’s impacts on climate change, pollution, water, biodiversity and resources. In-depth sustainability due diligence can also help you identify and manage any negative ESG impacts occuring in your supply chain. Impact materiality is the starting point of a DMA, followed by financial materiality.

Financial materiality

Financial materiality is about understanding the financial risks and opportunities your company and its value chain face as a result of issues relating to sustainability. Financial materiality is assessed after impact materiality because the material impacts you identified can transform into financial risks or opportunities for your company. For example, a negative impact on the environment, like a chemical spill from a factory, can materialize as a reputational and regulatory risk that will incur cost from lost business and sanctions. In addition to your company’s impacts, risks can also stem from your dependencies on resources, whether those be natural, human, or financial resources. However, sustainability issues not only pose risks, but also financial opportunities. These can take the form of cost savings, productivity gains and new revenue streams.

Assessment and prioritization of IROs

Once IROs have been identified using the above tools, they must be assessed and prioritized. In the case of impacts, the ESRS prescribes that this must be done according to their severity—a combination of their scale, scope and irremediability—and likelihood. For risks and opportunities, it is based on their magnitude and likelihood. All impacts passing a threshold deemed appropriate by the company are then deemed material from the impact perspective. Any of those topics are considered material for reporting if they are found to be material from either an impact or risk point of view.

The assessment of materiality should be done in as objective a way as possible, with all assumptions and “scoring” of materiality transparently such that could be understood by a third party, such as an auditor. EFRAG has provided a double materiality implementation guide to help companies in this process.

How to get started with a DMA?

There are several good starting points for the DMA.

The ESRS provides a list of topics, subtopics and sub-subtopics that is a recommended baseline for any DMA. A company can start by going through this list and discussing internally with any relevant experts if any of the topics are relevant from either the impact or financial perspective. External experts, NGOs and even affected stakeholders can also be consulted for their views.

Sector standards such as those published by the Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB) can help companies to identify IROs that are specific to their sector. This may uncover topics that are not included in the ESRS—so-called “entity-specific” topics—which they company can choose to report on if material. Note: EFRAG had originally planned to develop sector standards for the ESRS, but this activity may be halted as a result of the EU Omnibus proposal (stay tuned).

Once you have identified which issues are material to your business, you can then complete a gap analysis to see if you are collecting all of the required indicators relating to those issues. As mentioned above, ESRS provides a list of sustainability topics, subtopics and sub-subtopics, each of them associated with indicators—both qualitative and quantitative—required to report if the topic is material. EFRAG has prepared a mapping of subtopics to disclosure requirements to assist in this process. For “entity-specific” topics that are identified by companies in their DMA, the company must define their own indicators or use metrics from other recognized standards such as the GRI.

In practice, a gap analysis requires going through the requirements of the ESRS, datapoint by datapoint, to see if your company is collecting or reporting the required data. For companies that are already doing ESG reports, this gap analysis can be based on their latest report. For companies who are new to ESG, it will require reaching out to specialists throughout the company to inquire about what data is being collected or reported. It is likely that at least some data will already be available as it is required by law or is already being used by management to improve efficiencies or, in the case of HR data, track employee trends.

In practice, a gap analysis requires going through the requirements of the ESRS, datapoint by datapoint, to see if your company is collecting or reporting the required data. For companies that are already doing ESG reports, this gap analysis can be based on their latest report. For companies who are new to ESG, it will require reaching out to specialists throughout the company to inquire about what data is being collected or reported. It is likely that at least some data will already be available as it is required by law or is already being used by management to improve efficiencies or, in the case of HR data, track employee trends.

Once the gap analysis is complete, data collection can begin. The ESRS provides detailed instructions on how each indicator should be reported, to facilitate comparability between sustainability reports. This includes details such as units and the required level of granularity. Some indicators must be disaggregated by country of operation and all quantitative metrics require a comparator year. Therefore, existing data collection processes may have to be altered to suit these requirements. For data that is not yet being collected, companies will have to set up data collection processes and internal competencies. Large companies will likely have to set up specialized IT systems for unified data collection across the organization. This will streamline the process, ensure transparency, and reduce error.

Once data have been collected, companies can begin preparing their reporting.

Qualitative, or “narrative” indicators include reporting on company policies, action/transition plans, targets and metrics. Companies will have to either describe what they currently have in place or state that these documents and activities are not yet developed. Descriptions of policies, action plans, targets and metrics should follow the “Minimum Disclosure Requirements” or “MDRs” that can be found in ESRS 2 General Disclosures. Companies will also have to give an in-depth description of their assessment of financial risks and opportunities, which can be qualitative in the first three years of reporting. From the fourth year of reporting onwards (according to the current version of ESRS), companies must provide quantitative estimates of financial risks and opportunities.

Quantitative indicators have many formats, from single percentages and numbers to more extensive tables with multiple columns. Monetary data should be aligned and/or cross-referenced with financial data from the financial report.

For both qualitative and quantitative indicators, it is essential that report preparers refer back to the ESRS standards for full detailed instructions on how each indicator should be reported.

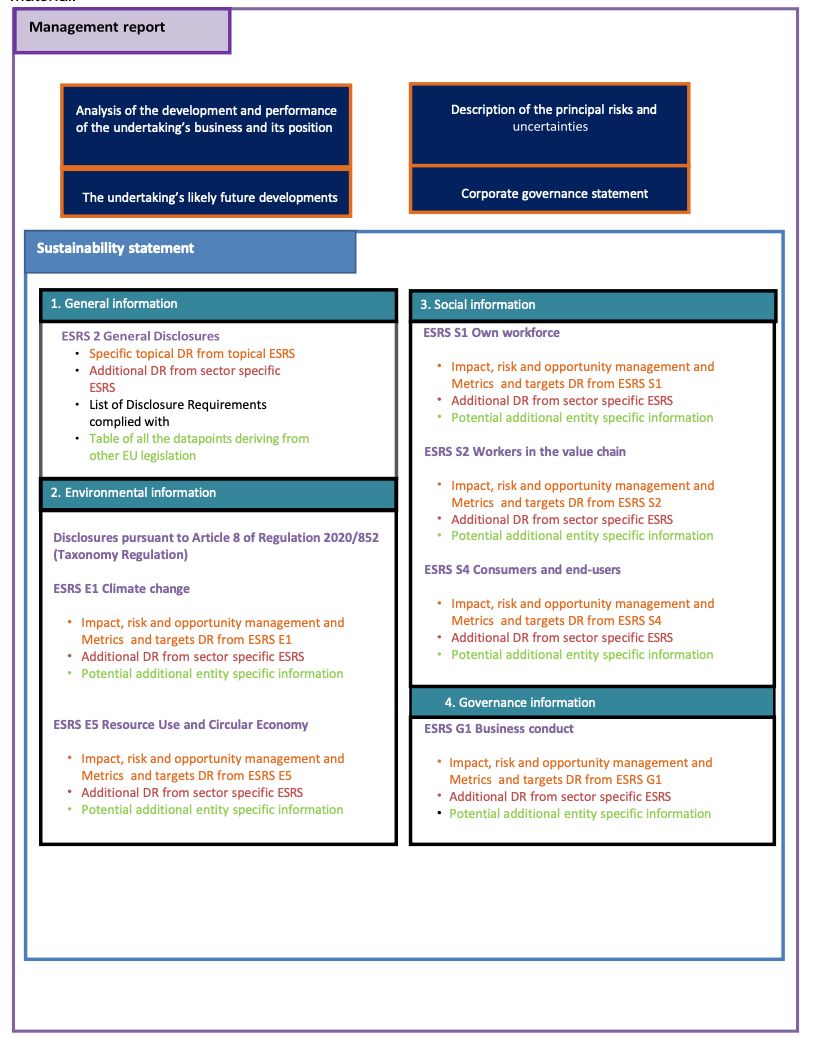

The ESRS report should have a specific format, with four sections: General Information, Environmental Information, Social Information and Governance Information. Appendix D and Appendix F of ESRS 1 provide examples of how this structure could look in more detail.

Sample ESRS report structure (ESRS 1, Appendix F)

The disclosures from the “General Disclosures” chapter must be reported in the first chapter of the report, except for the disclosures related to material impacts, risks and opportunities of each topic (SBM-3). Disclosures relating to each material topic should be reported separately, within the respective chapter. Each disclosure should be separately identifiable. Information relating to EU Taxonomy reporting should have a clearly delineated section within the Environmental chapter of the report.

It is still not clear if companies will be able to publish their reports in a simple pdf document as is currently the practice, or if they will also have to report the data in a specialized format according to the ESRS taxonomy. We are actively monitoring this and will post updates once available.

Sustainability reports should meet the qualitative characteristics defined in Appendix B of ESRS 1. These characteristics are:

- Relevance: Information should significantly influence the decisions of users by having predictive or confirmatory value.

- Faithful representation: The report must accurately and neutrally depict all necessary details of the impacts, risks, or opportunities.

- Comparability: Information should be consistent and easily comparable with previous periods and other similar entities.

- Verifiability: The report should provide information that can be independently corroborated to ensure its accuracy and completeness.

- Understandability: The report should be clear, concise, and comprehensible to an informed reader, avoiding unnecessary complexity or ambiguity.

Preparing an ESRS report is a demanding multi-stage task that will require months of preparation and the involvement of multiple stakeholders, both internal and external. To read more about the standards, check out our previous article covering everything you need to know about ESRS.