Efforts to avoid greenwashing and identify truly responsible companies have spurred the introduction of ESG sustainability ratings. This raises the question: what is the difference between standards, frameworks, rankings and ratings and how do they differ in their approach and purpose?

ESG investing is growing in popularity. Morningstar data shows that investors globally invested $142.5 billion in sustainable funds in the fourth quarter of 2021, up 12 percent from the previous quarter. At the same time, however, the amount of greenwashing in the sector is growing, as an article in the Financial Times highlighted.

With a huge number of often conflicting ESG metrics across markets, investors are beginning to rely on a combination of third-party assessments and proprietary research. They want to be sure that if they put money into a fund labelled “sustainable” or “green”, the fund will actually meet those criteria. Concerns about greenwashing not only undermine trust in institutions and the system as a whole, but above all pose a danger to the socio-economic and environmental challenges that the world is trying to address.

ESG standard vs. ESG framework

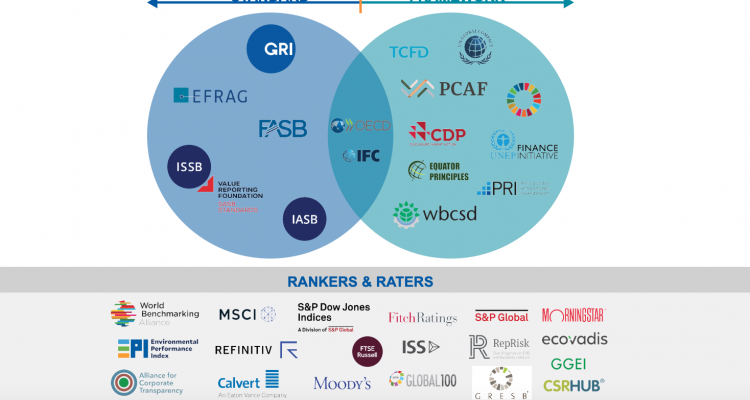

Sustainability standards and frameworks are generally issued by different organisations, though some focus on both, such as the OECD or IFC.

Standards have fixed requirements and contain specific and detailed criteria for what companies must report on each topic. All standards have several common features: public interest orientation, independence and due process.

The frameworks are then a set of principles that provide guidance on how to approach certain topics, but at the same time allow for a lot of flexibility in how to approach the topics. Unlike standards, they do not impose reporting obligations and are therefore less rigorous and thorough.

What do standards and frameworks have in common? Both are based on pressure from authorities - they are either legally required, or required by investors or corporate departments.

Evolution of ESG standards

Currently, there are only two reporting standards that address sustainability globally: the GRI and SASB, each with a different audience and scope. However, ESG data reporting is a very dynamic area that is evolving rapidly and two major changes are currently taking place:

- The European Sustainability Reporting Standard (ESRS) is being developed by the EU and will be based on 'dual materiality' for multiple stakeholders (including investors). The European Financial Reporting Advisory Group (EFRAG) is working with GRI to develop the standard.

- IFRS standards for disclosing financial information related to sustainable development is being introduced, which will be based on financial materiality and intended exclusively for investors. These standards are being developed by two IFRS Foundation boards, the International Sustainability Standards Board (ISSB) and the Accounting Standards Board (IASB).

The IFRS and EU processes are not in competition with each other, but rather complement each other. Different standards have different purposes and are for different audiences – those aimed solely at investors are based on a different concept than those aimed at a broader group of stakeholders. The GRI standards are the only global standards that focus on reporting for a broad range of stakeholders and are therefore an important tool in shaping the reporting structure of ESG data.

GRI is working with both EFRAG and ISSB to develop a suite of standards for sustainability reporting. The aim is to create a global structure with a core set of commonly disclosed information, which will stand on two pillars, financial standards and sustainability standards, both of which will have equal status.

The result will be a set of standards that not only meets the needs of all stakeholders, but also adds credibility to the reports that companies issue on their sustainability performance.

ESG ratings and rankings

In addition to standards and frameworks, there are also other ways to define ESG scores for organizations – ratings and rankings. In general, a company's ESG rating consists of a quantitative score and a risk category. Reporting standards and frameworks are also an important input for evaluating a company's ESG data and determining the rating or ranking score. Although it is often unclear what indicators actually make up a given rating, the importance of rankings and ratings is growing.

A company's credibility is based on its accountability and trust in its accountability can only be ensured through transparency. Frameworks without clear reporting obligations cannot achieve this purpose, but disclosure of relevant information based on widely used global standards that rely on both financial data and sustainability impacts and criteria can.