The aim of this guide is to help small and medium-sized companies (SMEs) improve their corporate sustainability and responsibility in the environmental, social and governance (ESG) fields in practice. With the development of the ESG market, legislative updates and changes in the expectations of customers, partners and investors, the field of sustainability plays an increasingly important role in building a strong and competitive business.

Welcome to part 2 of our ESG guide. In this section, we're looking at the EU's new Corporate Sustainability Reporting Directive (CSRD) and what it means for SMEs. We'll explain the changes in reporting requirements set for 2025 and highlight how these will affect your business.

Legislation for SMEs

In June 2022, the European Union approved the final form of the Corporate Sustainability Reporting Directive (CSRD), which expands the number of companies required to do sustainability reporting compared to the previous Non-Financial Reporting Directive (NFRD). From January 1, 2025, large companies with more than 250 employees will have to report their data. The CSRD directive also introduces new EU Sustainability Reporting Standards (ESRS), which standardise how companies will have to publish information on sustainability and ESG data.

SMEs listed on regulated markets will be affected by the CSRD regulation from 2026. However, two-year exemptions can be used to provide enough time to prepare for the disclosure of their ESG data. Non-listed SMEs are not currently required to report under the ESRS. However, voluntary guidelines for such companies are being prepared by EFRAG (the body issuing the ESRS).

Important! Although the Directive is currently only aimed at large companies, smaller companies may feel its effects, as companies reporting under international frameworks must also collect non-financial information from across their supply chain. It can therefore be assumed that small and medium-sized enterprises will have to publish data before this deadline because they will be required by customers and financial institutions – for example, to be able to calculate their carbon footprint (Scope 3 emissions).

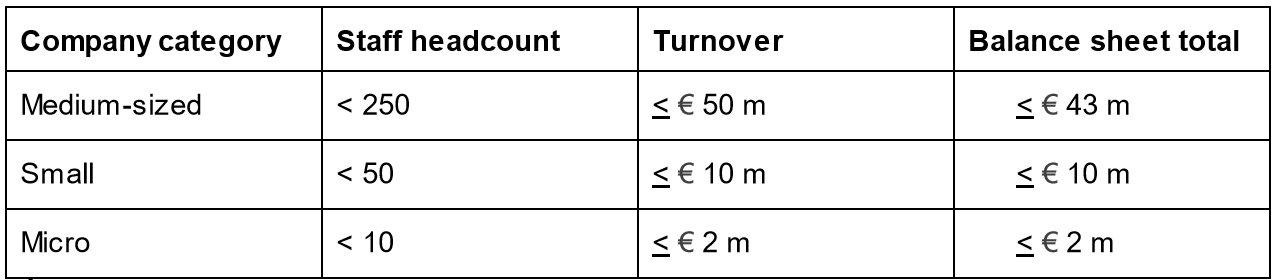

Definition of SMEs in the EU

According to EFRAG, SMEs listed on regulated markets should be able to “report according to standards that are proportionate to the capacities and resources of SMEs, and relevant to the scale and complexity of their activities''. The European Commission presented a proposal to develop simplified standards to make reporting more accessible for companies and thus reduce their administrative costs. These would include:

- A brief description of the company's business model and strategy

- A description of the company's policies in relation to sustainability matters

- The company's main actual or potential adverse impacts in areas E, S and G and the measures taken to identify, monitor, prevent, mitigate or remediate these impacts

- The main risks to the company in areas E, S and G and how the company manages these risks;

- The key indicators necessary for disclosure under items 1.-4 above.

Next, in part 3, we'll dive into setting up your ESG strategy, focusing on the first step: stakeholder identification and engagement. Understanding who your stakeholders are and how to effectively engage with them is a foundational step in developing a robust ESG strategy.