This article was updated in June 2025.

Contained in this article:

Background on the CSRD and EFRAG:

- What is the Corporate Sustainability Reporting Directive (CSRD)?

- How has the EU Omnibus package changed the CSRD?

- When will the revised ESRS following the Omnibus package be published?

- What is the difference between NFRD and CSRD and does CSRD replace the NFRD?

- Who is subject to the CSRD and what is the timeline?

- Is CSRD mandatory?

- What happens if my company doesn’t comply with the CSRD?Background on the CSRD

Details on the European Sustainability Reporting Standards (ESRS):

- What are the ESRS standards?

- What is double materiality and is it mandatory?

- How does my company conduct a materiality assessment according to the ESRS?

- Are the ESRS disclosures mandatory?

- Is a decarbonization plan mandatory?

- What methodology should companies use to measure their GHG emissions?

- What diversity indicators are included in the ESRS?

- What format must a CSRD report be in?

- Will my report have to be assured by a third party?

- Is assurance required from the beginning?

- Are value chain disclosures required from the beginning?

Background on the CSRD and EFRAG

What is the Corporate Sustainability Reporting Directive (CSRD)?

The CSRD is an EU directive that made it mandatory for large companies operating in Europe—namely those with more than 250 employees and either turnover exceeding EUR 50 million or a balance sheet total of more than EUR 25 million—to annually publish an audited sustainability report that follows the European Sustainability Reporting Standards (ESRS). The CSRD was adopted by the European Parliament on 10 November, 2022 and by the Council of the European Union on 28 November, 2022.

The first wave of reporting has already passed, with companies previously in the scope of the Non-Financial Reporting Directive (NFRD) having published their first CSRD-compliant reports in 2025.

How has the EU Omnibus package changed the CSRD?

In February 2025, the European Comission proposed significant changes to the CSRD and ESRS under the EU Omnibus package. The changes to CSRD proposed in this package include:

- Changing the scope of CSRD to reduce the number of companies required to report,

- Delaying the start of reporting by two years,

- Simplifying and streamlining the ESRS,

- Limiting the scope and content of the EU Taxonomy,

- Only requiring companies to receive reasonable assurance on their reports, based on audit guidelines that the EU Commission plans to issue by 2026, removing the future requirement to ahieve limited assurance,

- Introducing a new voluntary reporting standard for SMEs based on the already published VSME,

- Eliminating the sector standards that were under preparation.

Following this, in April 2025, the EU Council adopted the Stop The Clock Directive, which approved one of the Commission’s proposals to:

- Delay by two years the first date of reporting for “second wave” companies (those large companies who did not fall under the NFRD), and

- Delay by one year the deadline for Members States to transpose the CSRD into national law.

When will the revised ESRS following the Omnibus package be published?

An exposure draft of the amended ESRS is currently being prepared by EFRAG (the body responsible for drafting the ESRS) and is expected to be published for feedback in August and September 2025, with the final draft being presented to the EC in October.

What is the difference between NFRD and CSRD and does the CSRD replace the NFRD?

The CSRD replaced the Non-Financial Reporting Directive (NFRD). The main difference between the two directives are the inclusion criteria, which in the case of CSRD cover a larger number of companies. CSRD (in its current scope) requires environmental, social and governance (ESG) reporting from 49,000 companies in Europe, compared to the 11,000 covered by the NFRD directive. In the Czech Republic, Flagship’s home base, the number of companies required to report went up from 25 to 1,500.

Among the other differences are the requirement for third party assurance, new ESRS reporting guidelines, digital “tagging” to create machine-readable reports, and implementation of the double materiality principle. Read more details about the ESRS below.

Who is eligible for CSRD and what is the timeline for reporting?

The applicability and timeline of the CSRD will change as a result of the EU Omnibus package.

As mentioned above, the timeline for CSRD-compliant reporting according to the ESRS has been delayed by two years following the approval of the Stop the Clock Directive. Therefore, large companies with more than 250 employees and either EUR 50 million in turnover or EUR 25 million on their balance, who did not fall under the NFRD, will have to start reporting from the year 2027.

The CSRD in its current form also covers SMEs traded on EU markets, although many of these companies will likely fall out of scope under the Omnibus revisions. Currently, for small SMEs, companies meeting at least two of these criteria are included: a) 10-49 employees, b) EUR 700K-8M in net turnover, 3) EUR 350K-4M in assets. For medium SMEs, companies meeting at least two of these criteria are included: a) 50-249 employees, b) EUR 8M-40M in net turnover, c) EUR 4M-20M in assets. Listed SMEs will have to comply starting in 2026, for reports published in 2027, but they will be able to opt out until 2028.

As well as non-listed SMEs, the CSRD currently excludes listed micro-enterprises with ten or fewer employees and less than Euro 700K in net turnover or Euro 350K in assets.

Is the CSRD mandatory?

The CSRD is mandatory for all companies meeting the above-described criteria. These companies will have to publish a non-financial, or ESG report on an annual basis, using the EFRAG’s sustainability reporting standards (the ESRS).

What happens if my company doesn’t comply with the CSRD?

Not complying with the CSRD could lead to financial sanctions and public statements about the non-compliance, but also could lead to your company being excluded from investor portfolios.

Get in touch with us to find out how we can help you make sense of the alphabet soup and become CSRD compliant!

Details on the European Sustainability Reporting Standards (ESRS)

What are the ESRS standards?

The ESRS standards are the EU’s sustainability reporting standards, originally published as a Delegated Act in 2023, that define the disclosures that companies are required to include in their ESG reports. The ESRS give guidance on how companies should conduct a double materiality assessment and disclose information about their environmental and social impacts (both negative and positive), risks and opportunities as well as the governance structures they have in place to manage those risks and impacts.

The standards were developed to align with the EU’s Green Deal and Taxonomy, as well as the Global Reporting Initiative (GRI), the most widely-used international ESG reporting standards.

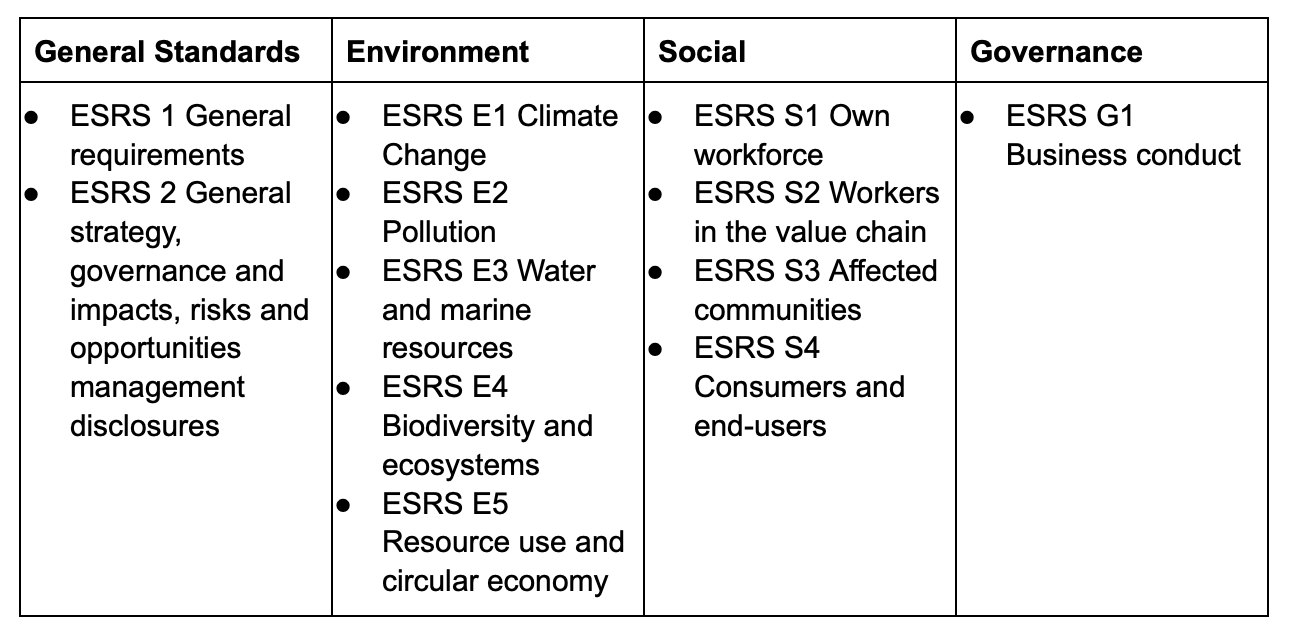

The ESRS are currently comprised of 12 documents covering the topics in the below table. As part of the Omnibus package, it is likely that this structure will change and possibly be reduced.

The 12 documents of the ESRS (2023 version)

Below, we answer some frequently asked questions about ESRS.

What is double materiality and is it mandatory?

Double materiality is a relatively new approach to materiality that was introduced as an integral part of the ESRS. It is currently a mandatory part of ESRS reporting that requires companis to look at both the “outside-in” impact of external events or circumstances on a company (“financial materiality”) as well as the “inside-out” impact of a company on the outside world (“impact materiality”). Double materiality is a core part of ESG reporting and strategy according to the ESRS. In the process of analyzing double materiality (also known as a double materiality assessment or DMA), the company finds out which topics should be reported on in their ESG report and prioritized for their strategy.

In the words of the ESRS, the two components of double materiality, impact materiality and financial materiality, are defined as followed:

“Impact materiality and financial materiality assessments are inter-related and the

interdependencies between these two dimensions shall be considered. In general the starting point is the assessment of impacts although there may also be material risks and opportunities that are not related to the undertaking’s impacts. A sustainability impact may be financially material from inception or become financially material when it could reasonably be expected to affect the undertaking’s financial position financial performance cash flows its access to finance or cost of capital over the short- medium- or long-term. Impacts are captured by the impact materiality perspective irrespective of whether or not they are financially material.” (ESRS 1 General Requirements, paragraph 37)

“A sustainability matter is material from an impact perspective when it pertains to the undertaking’s material actual or potential positive or negative impacts on people or the environment over the short- medium- or long-term. Impacts include those connected with the undertaking’s own operations and upstream and downstream value chain including through its products and services as well as through its business relationships. Business relationships include those in the undertaking’s upstream and downstream value chain and are not limited to direct contractual relationships.” (ESRS 1 General Requirements, paragraph 43)

“A sustainability matter is material from a financial perspective if it triggers or could reasonably be expected to trigger material financial effects on the undertaking. This is the case when a sustainability matter generates risks or opportunities that have a material influence or could reasonably be expected to have a material influence on the undertaking’s development financial position financial performance cash flows access to finance or cost of capital over the short- medium- or long-term. Risks and opportunities may derive from past events or future events. The financial materiality of a sustainability matter is not constrained to matters that are within the control of the undertaking but includes information on material risks and opportunities attributable to business relationships beyond the scope of consolidation used

in the preparation of financial statements..” (ESRS 1 General Requirements, paragraph 49).

How does my company conduct a materiality assessment according to the ESRS?

EFRAG prepared a separate detailed guidance document entitled Implementation Guidance 1: Materiality Assessment, which provides a step-by-step guide to conducting a DMA.

The steps of an ESRS materiality assessment include:

- Mapping the context of the company’s business activities, business relationships and stakeholders.

- Considering the relevance of the list of topics, subtopics and sub-subtopics covered by the topical ESRS to your company (see ESRS 1, AR 16 for the full list).

- Researching other sources including sector standards from bodies such as GRI or SASB to identify impacts, risks and opportunities that are known to be associated with your company’s sector.

- Engaging with internal and external stakeholders to identify and assess the serverity and likelihood of company-specific impacts, risks and opportunities.

- Assessing impacts, risks and opportunities according to the criteria prescribed by the ESRS:

- For impacts, assessment is based on severity and likelihood, with severity being comprised of three variables: a) scale (how grave), b) scope (how widespread) and c) irremediability (how hard to correct).

- For risks and opportunities, assessment is based on the magnitude and likelihood of occuring.

- Defining a threshold, above which an impact, risk or opportunity becomes material to the company.

- Validating the final list of material impacts, risks and opportunities with top management, and if desired, key external stakeholders.

A materiality assessment is a relatively complex process that requires a significant time investment. We can help you conduct your stakeholder dialogues, industry benchmarking, materiality assessment and prioritization of topics.

Are the ESRS disclosures mandatory?

Currently, only the disclosures from ESRS 2 are mandatory for all companies, including information about sustainablity governance and due diligence, and the process and outcome of the materiality assessment. The disclosures of the topical standards are only mandatory if that topic was found to be material in the DMA and if the disclosure requirement contains the word “shall”. Disclosure requirements that contain the word “may” are optional.

If a company finds climate change to be a non-material topic, they must justify this with an explanation. This is not required of the other topics.

Is a decarbonization plan mandatory?

The short answer is: yes.

Reporting scope 1, 2 and 3 greenhouse gas (GHG) emissions and a Climate Transition Plan are among the disclosures in the ESRS E1 Climate Change chapter.

The climate change chapter of the ESRS also requires companies to disclose:

- Integration of climate change strategies into performance and incentive schemes

- Resilience of strategy and business model

- Description of processes to identify and assess material climate-related impacts, risks and opportunities

- Policies related to climate change mitigation and adaptation

- Action plans and resources in relation to climate change policies and targets

- Targets related to climate change mitigation and adaptation

- Energy consumption and mix

- GHG removals and GHG mitigation projects financed through carbon credits

- Internal carbon pricing

- Potential financial effects from material physical risks, material transition risks and climate-related opportunities

What methodology should companies use to measure their GHG emissions?

The ESRS suggests that companies consider using the methodology of the GHG Protocol, GRI or the requirements of ISO 14064-1:2018. As they write:

“Consider the principles, requirements and guidance provided by the GHG Protocol Corporate Standard (version 2004 or the latest one) and GRI 305 (version 2016 which is directly based on the requirements of the GHG Protocol). The undertaking may consider the requirements stipulated by ISO 14064-1:2018. If the undertaking already applies the GHG accounting methodology of ISO 14064-1: 2018, it shall nevertheless comply with the requirements of this standard (e.g., regarding reporting boundaries and the disclosure of market-based Scope 2 GHG emissions).” (ESRS E1 Climate Change, AR 39a)

What diversity indicators are included in the ESRS?

Diversity disclosures are covered in ESRS S1 Own workforce, and includes these disclosures:

- The gender distribution in number and percentage at top management level amongst its employees.

- The distribution of employees by age group: under 30 years old, 30-50 years old; over 50 years old.

- Percentage gap in pay between women and men and the ratio between the compensation of its highest paid individual and the median compensation for its employees.

- Percentage of persons with disabilities in its own workforce.

What format must a CSRD report be in?

A CSRD report must have four sections: 1. General Information (disclosures from ESRS 2), 2. Environmental Information (disclousres from ESRS E1-5), Social Information (disclosures from ESRS S1-4) and Governance Information (disclosures from ESRS G1). According to the original ESRS published in 2023, reports will eventually be required to be published in a machine-readable format with XBRL tagging, however it remains to be seen whether this requirement will be maintained in the final Omnibus version of the ESRS.

Will my report have to be assured by a third party?

Yes, the ESRS currently requires that companies receive third party assurance for their report to ensure the quality of the data reported, as is done for financial reporting. Assurance can be provided by auditors or third party assurance services.

While originally the CSRD had stipulated that companies would have to aquire reasonable assurance initially followed by limited assurance at a later stage, the EU Omnibus proposals have suggested removing the requirement for limited assurance. Stay tuned to find out what the final outcome of the EU Omnibus will be, potentially as early as the end of 2025.

Are value chain disclosures required from the beginning?

Given the difficulty in collecting data on the full value chain, companies will be able to omit these disclosures for the first three years. However, after that point they will be expected to report on the full value chain.

Have any other questions about preparing a compliant ESRS report? Get in touch with us today!