Sustainability is sometimes regarded as a secondary concern in the corporate world, often addressed after the primary business priorities—such as profit margins, shareholder value, and staying ahead of the competition—have been managed. The usual discussions around sustainability, using terms like "brand loyalty" and "consumer trust," may not always resonate with top corporate leaders. Why? Because it doesn't speak to the immediate, concrete challenges that CEOs face daily.

To truly capture leadership's attention, we need to cut through the repetitive phrases and address sustainability from a perspective that matters: the survival and competitive advantage of business in a rapidly changing world. The answer lies in viewing sustainability not as a cost but as a way to future-proof the business, mitigate long-term risks and negative impacts, and unlock new opportunities that align with the evolving market landscape.

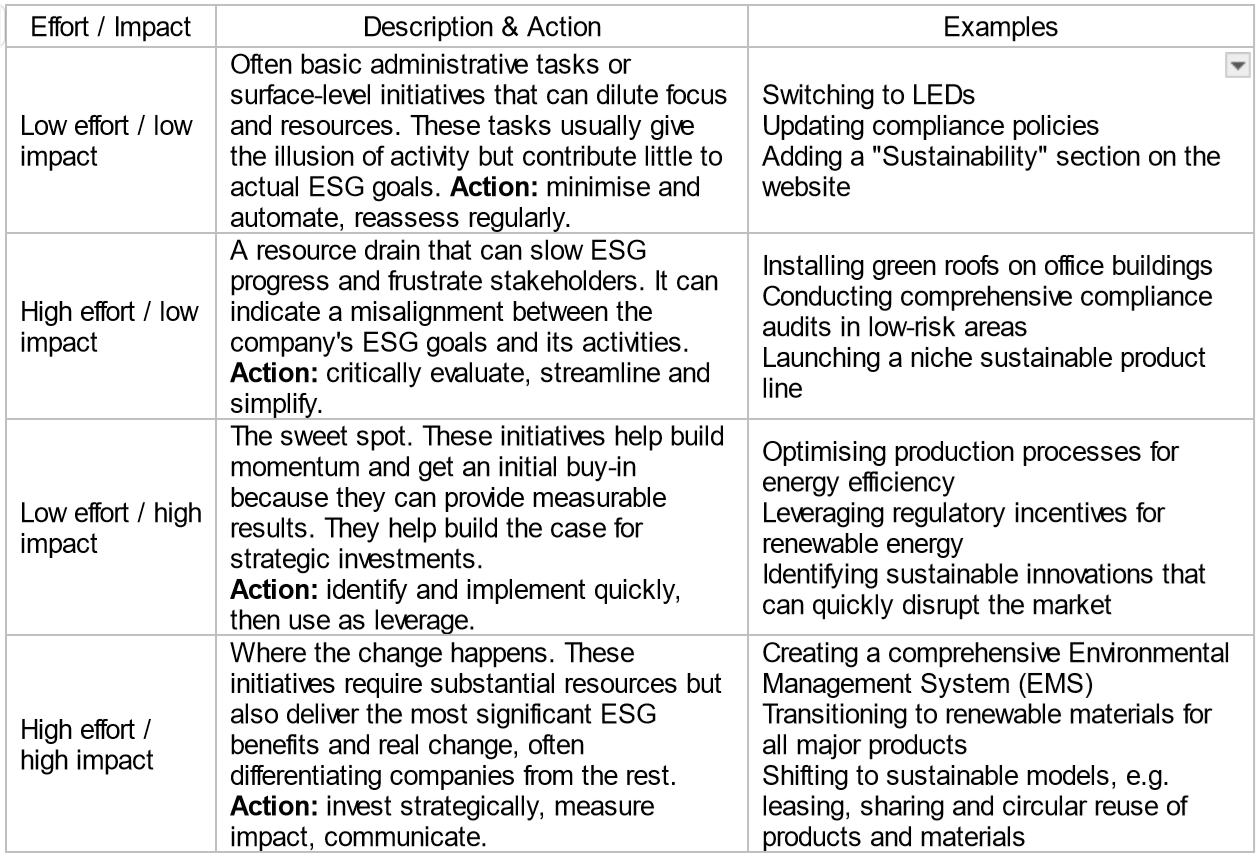

By leveraging tools like the Impact / Effort matrix, companies can focus their sustainability and ESG* efforts where they will have the most significant positive impact, ensuring that every initiative contributes to the business's strategic goals. Here's how to make a compelling, reality-based case for sustainability.

1. Profit protection: the hidden cost of inaction

CEOs are laser-focused on the bottom line, and rightfully so. The issue with viewing sustainability as an add-on means not only that it won't turn around its negative impacts. It is also leaving the business vulnerable to massive, unforeseen costs that can harm its prosperity. Plus, sustainable practices can enhance operational efficiency, leading to cost savings and improved profit margins. Sustainability is a critical investment in reducing long-term operational risks, avoiding hefty fines and maintaining favourable financial terms. If you think sustainability is expensive, imagine dealing with the costs of not being sustainable.

What can the costs of business's sustainability underperformance look like?

- Hidden costs of resource dependence: Many industries are heavily reliant on finite resources—water, fossil fuels, and rare minerals. What happens when these resources become scarce or supply chains get disrupted by natural disasters? Prices skyrocket, supply becomes inconsistent, and operational costs soar. Consider this: Coca-Cola faced massive backlash and operational issues in India as it caused water scarcity, leading to protests and plant shutdowns. Ignoring resource sustainability isn't just risky; it threatens business continuity.

- Reactive spending: Waiting to react to environmental regulations or disasters is a guaranteed way to burn through cash reserves. After the Deepwater Horizon oil spill, BP paid over $65 billion in fines and cleanup costs. A proactive approach to sustainability is not about meeting some idealistic standard but protecting the company from massive, avoidable financial hits. Sustainability is not a cost—it's a risk management strategy.

- Insurance and financing premiums: Companies with poor environmental records face higher insurance premiums. Insurers and lenders are increasingly factoring ESG risks into their assessments. If your company is a sustainability laggard, expect to pay more for capital and insurance. Sustainability is not about avoiding fines but securing favourable financial terms.

2. Regulation as an opportunity, not a threat

The truth is that regulatory landscapes are shifting, and those shifts are accelerating. Ignoring this reality is a fast track to operational chaos and financial penalties. CEOs understand that regulation is not just a threat to be managed; it's an opportunity to be leveraged.

How can companies leverage sustainability regulation?

- Regulatory foresight saves money: The European Union's Green Deal and carbon pricing initiatives are not going away. If anything, similar regulations will spread globally. Companies that invest in reducing their carbon footprint now will be far better positioned to avoid the fines and compliance costs that will crush laggards. This isn't about being virtuous; it's about being prepared.

- First-mover advantage: Companies that align with emerging regulations can gain significant competitive advantage. Being a first mover in sustainability means not only compliance but also setting the standard others must follow. Tesla isn't just a car company - it's a tech and energy company that leveraged early compliance with sustainable practices to dominate a market. Regulations are not barriers; they are market-shaping tools.

- Securing licenses to operate: In many regions, obtaining or renewing operational licenses increasingly depends on sustainability performance. This is particularly true for industries like mining, forestry, and agriculture. Sustainable practices are becoming prerequisites, not optional extras. Ignore this and watch your business face operational halts, community protests, or worse, shutdowns.

3. Market share: sustainability as a competitive tool

Sustainability can be the differentiator that allows a company to outmaneuver and outcompete others. But when we're talking about standing out, we are not talking about making small, incremental changes and therefore small gains; we are focusing on changes that allow businesses to leverage sustainability to capture and dominate market segments.

How can companies leverage sustainability for market share gain?

- Disrupting the status quo: Established industries are ripe for disruption. Companies that integrate sustainability into their core business strategy are well-positioned to challenge incumbents. For example, the shift towards renewable energy isn't just a feel-good initiative; it's about redefining the entire energy market. Companies like Ørsted have transformed from fossil-fuel giants to renewable leaders and, in doing so, have redefined their market position.

- Cost parity as a market power move: When sustainable products reach cost parity with traditional options, they win. Period. The electric vehicle market is a prime example. Tesla's focus on driving down battery costs is setting the stage for mass adoption. As soon as sustainable options are equally priced or cheaper, consumer preferences will flip. Businesses that anticipate and prepare for this shift will capture market share.

- Leveraging consumer pressure: While consumers may not always choose sustainability if it costs more, the tide is shifting as sustainable options become more affordable. Public sentiment and media scrutiny mean companies cannot ignore sustainability without risking brand damage. But more importantly, sustainability is becoming a factor in B2B sales. Major corporations are now selecting suppliers based on sustainability criteria, which can either open doors or shut companies out of lucrative contracts.

Applying the Impact / Effort matrix:

To effectively focus your sustainability strategy, it's crucial to prioritise ESG initiatives based on their potential impact and the effort required. The Impact-Effort matrix helps identify where to focus resources to achieve the most significant financial benefits.

Waking up to the reality of sustainability

Sustainability is not a side project or a box to tick; it's a strategic imperative that cannot be ignored. Companies that get ahead on sustainability will not only avoid the pitfalls of environmental and social negligence but also position themselves to dominate their industries.

Embedding sustainability into the core of business operations involves making smart, strategic decisions that protect and grow the business in a way that also gives it a social license. Sustainability is good for business because it mitigates risk, lowers costs, leverages regulations, and positions companies to seize new market opportunities. The choice is clear: lead on sustainability or watch as others lead your market.

* How we differentiate between Sustainability and ESG strategies

Sustainability strategy aims to make sure that a business strategy and its operations are carried out in an ethical and responsible manner. It encompasses a company's efforts to minimise its negative impacts on people and the planet in the short term and turn them into positive impacts in the long term.

ESG strategy is part of a sustainability strategy. It is a structured framework for evaluating specific, data-driven, and measurable criteria within the environmental, social, and governance areas.